Third Party Payment Processors Association

833 307 1542 articles tools view all.

Third party payment processors association. Product description goes here. Non bank or third party payment processors are financial institution customers that provide payment processing services to merchants and other business entities typically initiating transactions on behalf of merchant clients that do not have a direct relationship with the payment processor s financial institution. Speak with a commercial banking relationship manager. This paper will focus on the facilitation of payments between buyers and sellers and how they can work.

The third party payment processors association tpppa serves to promote the interests of payment processors their financial institutions and their merchants. In this case the payment processor should maintain records to allocate the deposit account balance among the merchant clients. Third party payment processors association. Tppps are legally responsible for the funds of each electronic transaction when those funds are not in the hands of either the buyer or merchant.

Third party payment processors tppps are critical participants in the payment ecosystem. Build your client list without cold calling. Monday friday 9am to 5pm pst excluding holidays. The third party payment processors association tpppa is a national not for profit industry association representing promoting the interests of payment processors their financial institutions their merchants.

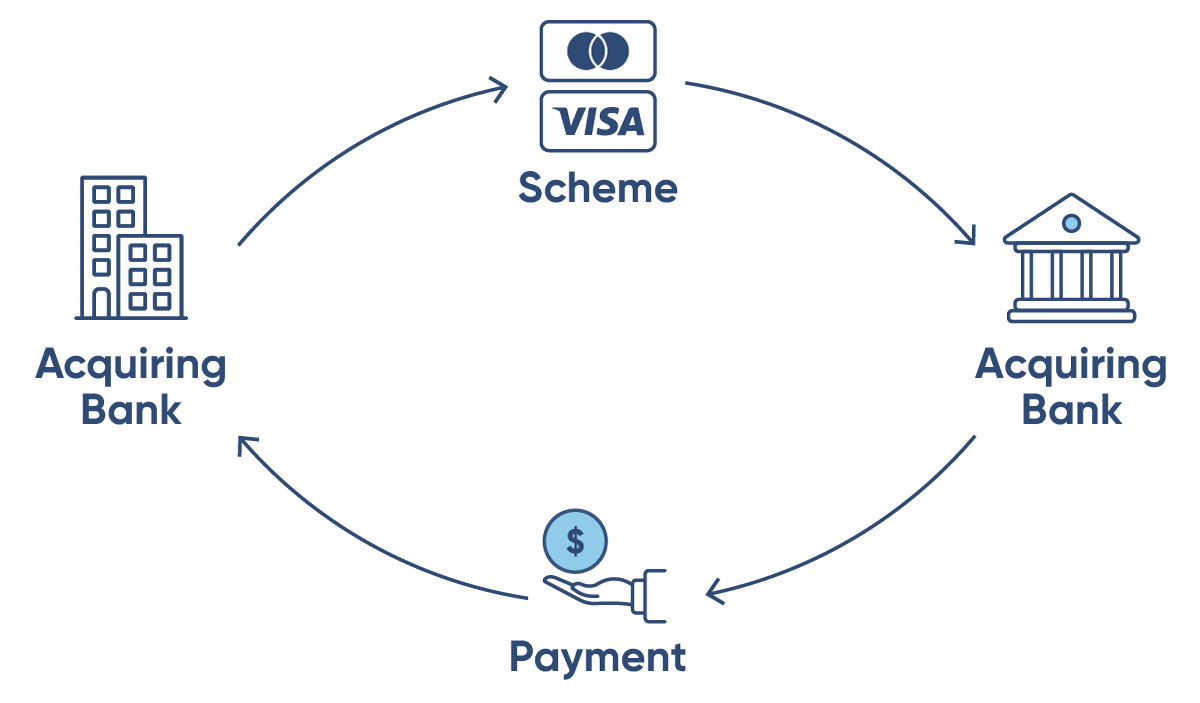

Front end processors have connections to various. A payment processor is some sort of transactor for financial calculations technically an invertible currency exchange often a third party appointed by a merchant to handle transactions from various channels such as credit cards and debit cards for merchant acquiring banks they are usually broken down into two types. Assess the adequacy of the bank s systems to manage the risks associated with its relationships with third party payment processors and management s ability to implement effective monitoring and reporting systems. Payment types used by third party payment processors payment processors may offer merchants a variety of alternatives for accepting payments including credit and debit card transactions.

Third party payment processors typically use a commercial bank account to conduct payment processing for their merchants and the bank does not have a direct relationship with the merchant. There are thousands of payment processors in the u s.